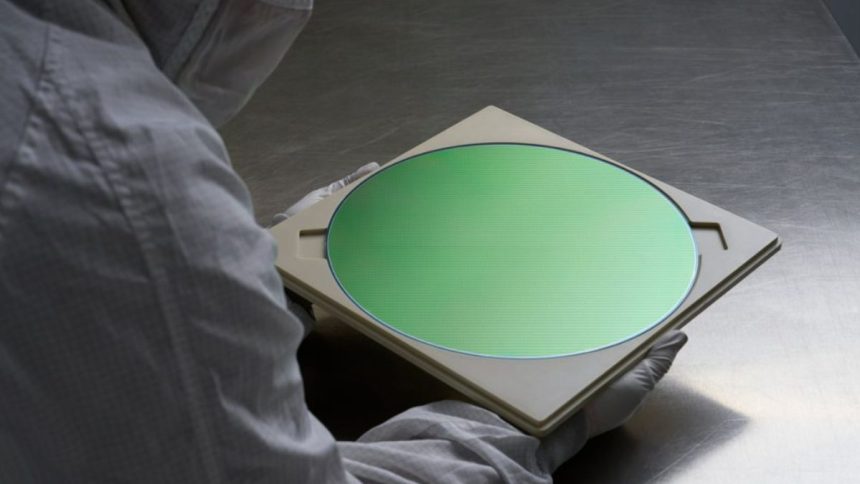

Apple has announced a sweeping new $100 billion investment as part of its American Manufacturing Program (AMP), boosting its projected U.S. spending to $600 billion over the next four years. This initiative is designed to reinforce the company’s domestic supply chain, accelerate local production of critical components like chips, cover glass, and AI servers, and create high-tech jobs in the United States.

Key Features of the Apple’s American Manufacturing Program (AMP)

- Strengthening U.S. Supply Chains: AMP focuses on not only expanding Apple’s domestic facilities but also encouraging global suppliers to build more components, such as silicon chips, rare earth magnets, and specialty glass, within the United States.

- Key Partnerships Across the Country:

- Corning (Harrodsburg, KY): Apple is committing $2.5 billion to manufacture all iPhone and Apple Watch cover glass in Kentucky. The plant will feature the largest smartphone glass production line globally and a new R&D center.

- Coherent (Sherman, TX): Multi-year supply agreement for VCSEL lasers, used in Face ID.

- MP Materials (Fort Worth, TX & Mountain Pass, CA): Supplying American-made rare earth magnets and developing a recycling line to support a domestic, sustainable supply chain.

- Building a U.S. Silicon Supply Chain:

- TSMC (Phoenix, AZ): Apple remains the first and largest customer for cutting-edge chip manufacturing at the Arizona fab, working with GlobalWafers America for U.S.-sourced silicon wafers.

- Texas Instruments, Samsung, GlobalFoundries, Amkor, Broadcom: Partners across multiple states are contributing semiconductors, packaging, testing, and 5G components, building a robust, end-to-end chip production capability within the U.S..

- Apple Server Manufacturing Moves to Texas: A new 250,000-square-foot facility in Houston will begin mass production in 2026, assembling AI and Private Cloud Compute servers that were previously made overseas.

- Manufacturing Academy and R&D Expansion: The Apple Manufacturing Academy in Detroit will support small- and medium-sized manufacturers with training in AI and automation, while data center expansion is underway in North Carolina, Iowa, Nevada, and Oregon to strengthen Apple’s cloud and AI services.

- Job Creation: Apple’s investment aims to add 20,000 new U.S. jobs, largely in fields such as artificial intelligence, machine learning, silicon engineering, and software development.

- Corning’s Central Role: Notably, Corning not only makes all Apple device cover glass in the U.S., but also provides silicon materials to GlobalWafers America, connecting the glass and silicon supply chains and reinforcing the integrated nature of Apple’s domestic manufacturing.

Broader Context and Strategic Impact

This commitment comes as Apple adapts to shifting global trade dynamics and increasing political and market pressure to reshore manufacturing. The expanded U.S. investment helps Apple mitigate the impact of tariffs, reduce risk associated with overseas supply disruptions, and reinforce its position as a key driver of high-tech manufacturing and innovation in America.

Apple’s $100 billion AMP supplements an already massive investment plan, supporting expanded domestic production of glass, silicon chips, rare earth magnets, and next-generation server hardware. The initiative is tightly coupled with Apple’s innovation pipeline, emphasizing advanced manufacturing, robust supply chains, and a skilled U.S. technical workforce needed to propel the company’s long-term industrial and technological leadership.