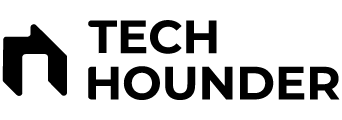

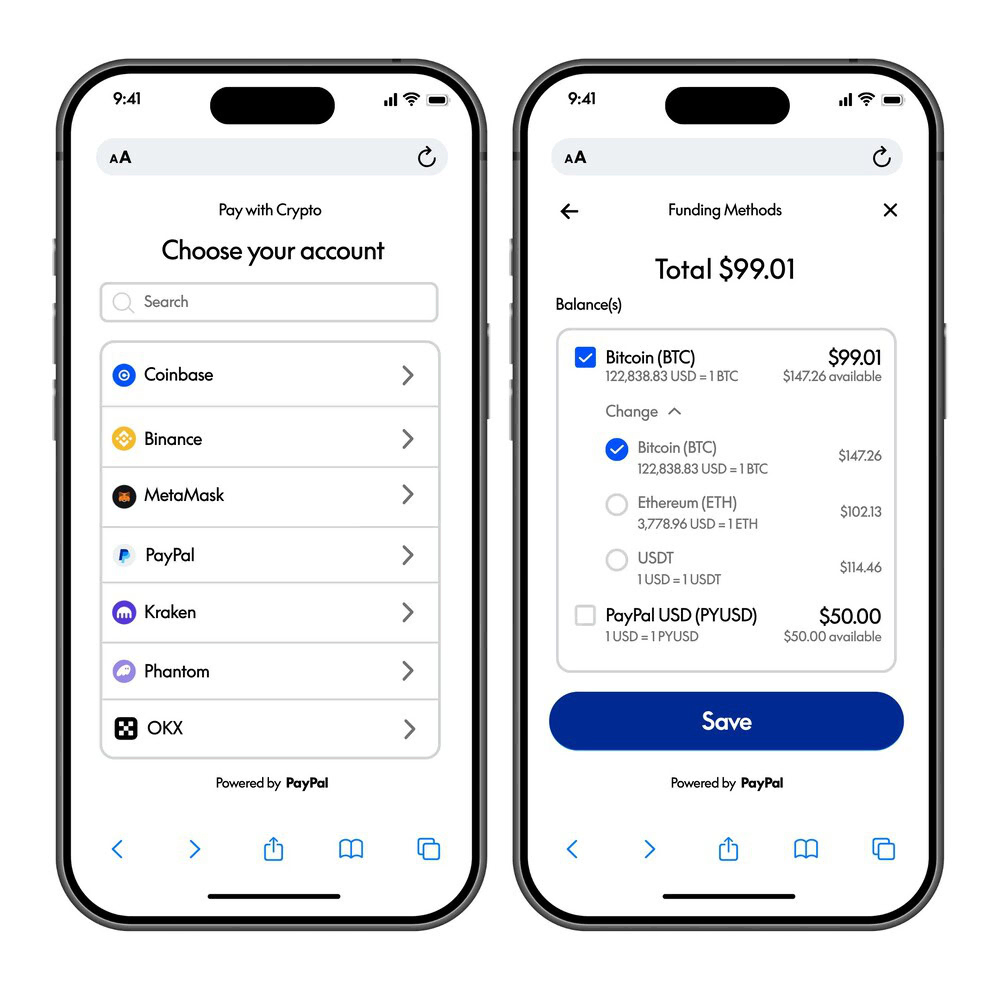

PayPal has launched a new service called “Pay with Crypto” aimed at U.S. merchants, enabling them to accept payments in over 100 cryptocurrencies, including Bitcoin, Ethereum, Solana, USDT, and USDC. This service greatly reduces the cost of cross-border transactions by slashing fees by up to 90%, charging a promotional transaction fee of just 0.99% for the first year, which is significantly lower than the typical 1.57% average international credit card fee merchants paid in 2024. After the first year, fees will increase to 1.5%.

Merchants can instantly convert received crypto payments into fiat currency or PayPal’s own stablecoin, PYUSD, which maintains a 1:1 peg with the US dollar. Holding funds in PYUSD offers merchants the opportunity to earn up to a 4% yield, and PayPal promises near-instant access to earnings, eliminating the usual delays associated with international settlements.

This initiative reflects PayPal’s broader strategy to integrate digital assets into mainstream commerce. It follows the company’s recent partnerships, such as with Fiserv to expand stablecoin adoption globally, and the launch of “PayPal World,” which connects major digital wallets worldwide to facilitate seamless, low-cost global transactions.

PayPal CEO Alex Chriss highlighted that the platform is designed to help businesses of all sizes overcome the complexities and high costs of international payments, ultimately expanding their global reach by tapping into the growing market of over 650 million crypto users worldwide.

, PayPal’s “Pay with Crypto” service offers merchants a powerful tool to accept a diverse range of cryptocurrencies with dramatically lower fees, faster settlements, and added benefits from PYUSD holdings, marking a significant push to embed cryptocurrencies more deeply into everyday commerce.